Smart Money Moves: How to Celebrate Big Moments and Still Buy a Home

Saving for a home doesn’t mean putting your entire life on pause.

You still want to celebrate your friends’ milestones, take the occasional vacation, and enjoy your weekends. But without a plan, those “one-off” expenses can quietly eat into your down payment fund.

Take wedding season as an example: between travel, gifts, outfits, and pre-wedding festivities, the cost of attending just one wedding, plus a bachelor or bachelorette weekend, costs an average of $2,016.

That’s pretty close to the typical monthly rent of $2,072. When you stack two or three weddings in one summer, and add in birthdays, holiday spending, and spur-of-the-moment events, it’s no wonder it feels impossible to save.

The truth is, you don’t need to say no to every invitation or skip every luxury coffee. You just need a strategy that helps you spend intentionally, save consistently, and keep your homeownership goals front and center.

Why Saving Feels So Hard Right Now

We’re living in a time of high rent, rising home prices, and inflation that makes everything from groceries to gas more expensive. Without a clear system, it’s easy to:

-

Dip into savings for “just one” celebration or event

-

Let subscriptions and small expenses pile up

-

Delay putting money aside because the target feels too big

And renters feel that financial strain. A recent survey found that:

-

45% reported making a housing sacrifice to afford wedding celebrations.

-

15% opted for a smaller rental or starter home, and 11% chose to live with roommates.

-

25% said they’ve turned down at least one event because the cost was just too high.

The good news is that a few intentional changes can make your savings feel achievable again.

7 Money Habits to Start Today

Here are simple strategies I recommend to renters and future buyers:

1. Set Your Budget

Before you say “yes” to any trip or invitation, you need to know what you can actually afford.

Set a realistic rent budget. You can do this with the 50/30/20 budgeting rule: 50% for needs (like housing), 30% for wants (including weddings), and 20% for savings or debt repayment.

2. Lock in Your Housing Savings

Treat your down payment or housing savings like a non-negotiable bill. Automate transfers into a separate savings account every payday so you’re paying yourself first.

3. Build an emergency fund or “Whoops fund”

Start small and build on it to provide a cushion for unexpected costs. Using a round-up tool like Acorns can make it easier to save money. If possible, keep the funds in a high-interest savings account.

4. Lower Your Monthly Bills

A record 36% of rentals offered concessions in July, including free rent or free parking. If you are moving or your current lease is coming up, ask about these incentives to free up money for other priorities.

If that’s not an option, start looking at other monthly expenses, including utilities, water, phone and internet. Call each provider to learn about your options to lower these bills. Even small adjustments, like canceling unused subscriptions or cooking at home more often, add up.

5. Choose Events Intentionally

You don’t have to skip every celebration, but prioritize what matters most.

You can also get creative with the events you do attend. Sharing costs or attending only part of an event can save you hundreds of dollars without skipping celebrations.

6. Automate Your Bills and Savings

Set up autopay for recurring expenses and automatic savings contributions. The less you rely on willpower, the easier it is to hit your goals.

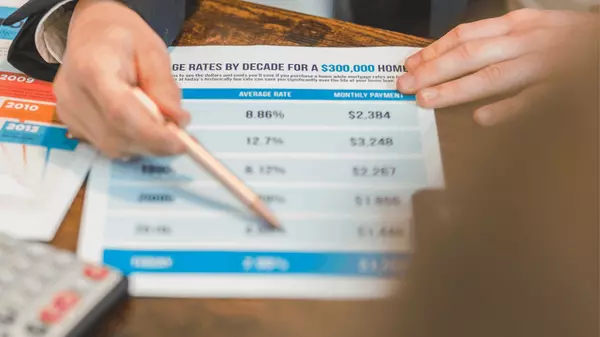

7. Consider All Your Options to Homeownership

A lot of people still believe that you need a 20% down payment to buy a home. But there are plenty of loan programs and incentives designed to make homeownership more accessible, with some offering down payments as low as 0-3%.

Be sure to talk with a real estate professional to learn about all the available options in Colorado Springs.

The Big Picture

Buying a home is one of the most rewarding milestones you can reach, but it doesn’t happen by accident. With the right plan, you can celebrate life’s biggest moments and still stay on track to own your dream home in Colorado Springs.

Recent Posts